In december 2017 after many months of stalled negotiations the basel committee on banking supervision bcbs announced an agreement to complete the finalized basel iii rules also known as basel iv.

Basel 4 output floor calculation.

Changes to internal models introduced by the basel committee the eba and the ecb.

The output floor is designed to reduce inconsistency in rwas not justified by risk.

And the application of a capital floor to limit.

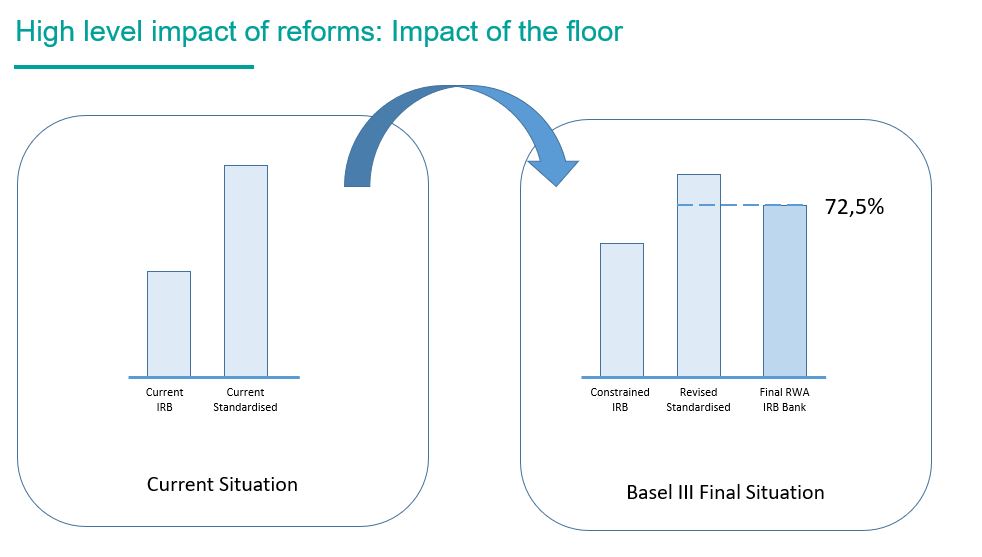

The output floor ensures that banks capital requirements do not fall below a certain percentage of capital requirements derived under standardised approaches.

The eba has published a number of regulatory documents.

Non modelling approach must be updated to reflect the prevailing basel capital standards in force at the time of the floor calculation.

Use of the irb approach the output floor and the revised standardised approach and to assess corresponding business decisions.

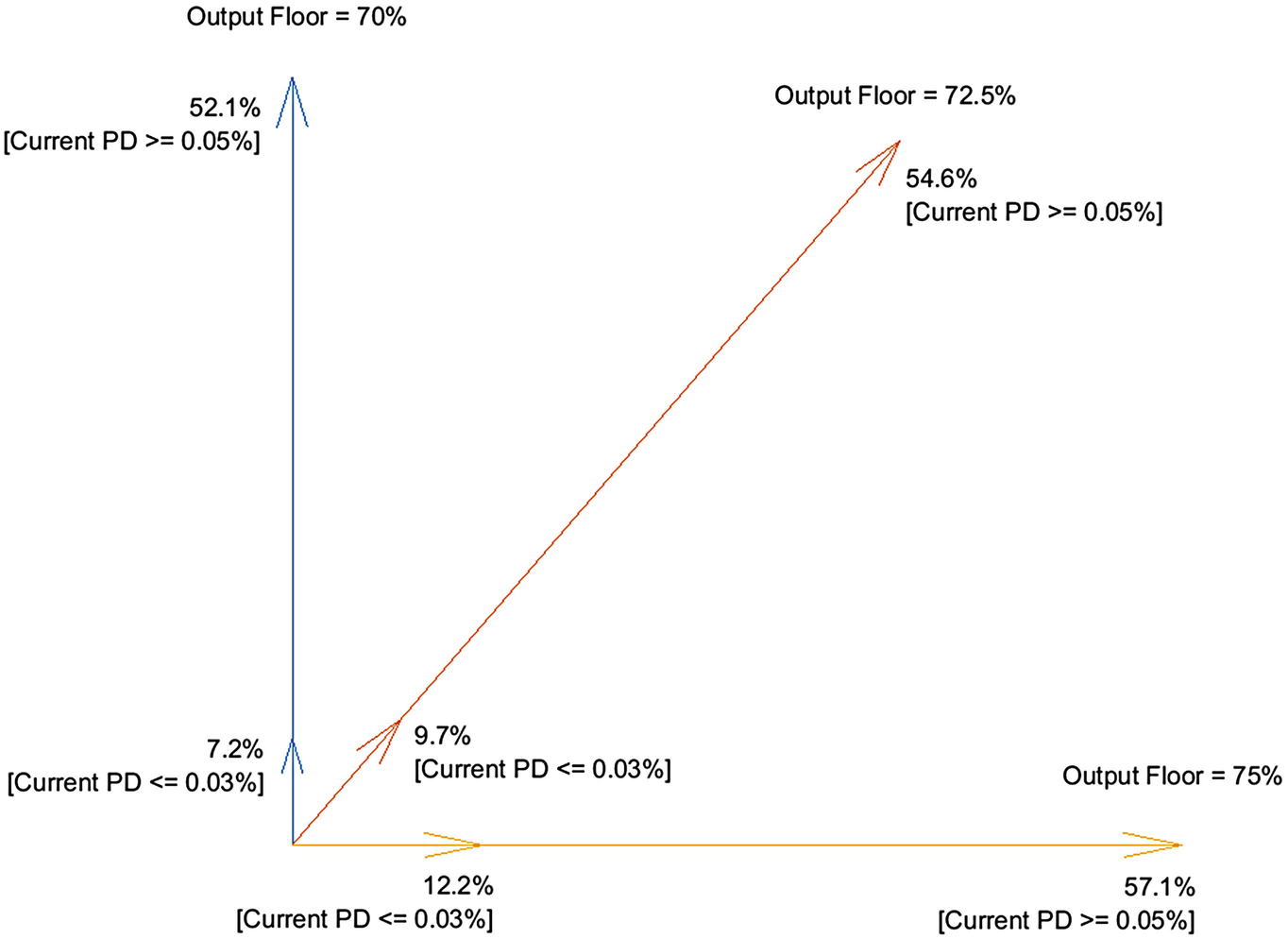

For example banks with focused business models could face a significant irb output floor requirement.

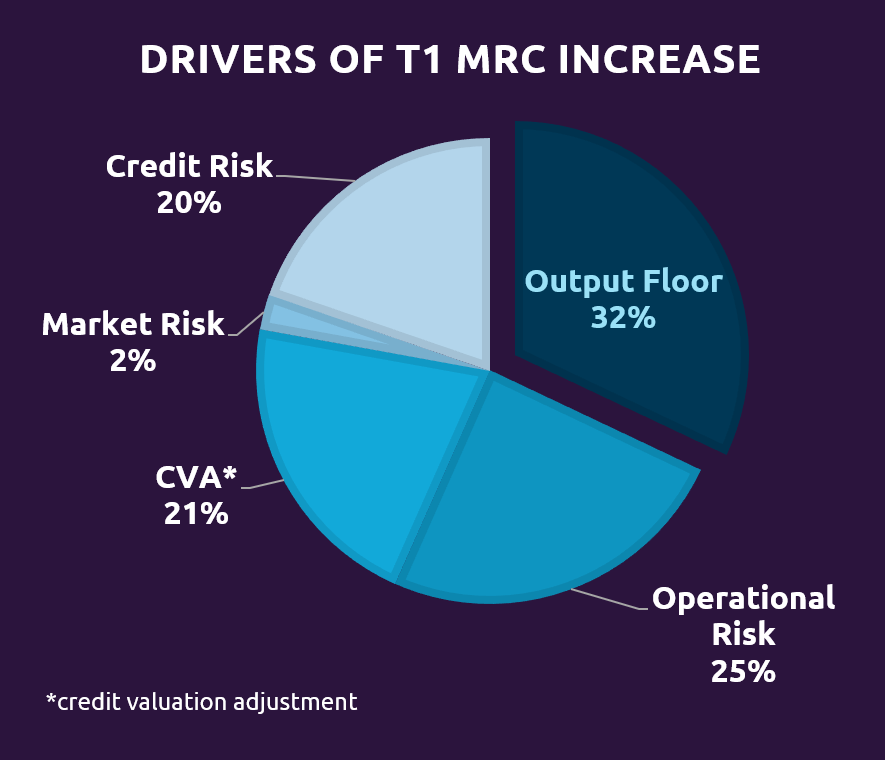

The basel framework describes how to calculate rwa for credit risk market risk and operational risk.

Robust risk sensitive output floor based on the revised standardised approaches.

Banks calculations of rwas generated by internal models cannot in aggregate fall below 72 5 of the risk weighted assets computed by the standardised approaches.

One of the key components of the basel iv package is the output floor which sets a floor in capital requirements calculated under internal models at 72 5 of those required under standardised approaches for calculating capital requirements for all pillar 1 risks.

The use of this alternative is subject to supervisory approval.

Kpmg member firms have developed the basel 4 calculator as.

The standardised approaches to be used to calculate the base of the output floor referenced in rbc20 4 2 are as follows.

A shift to a single standardised approach to operational risk.

The final agreement introduces an output capital floor one of the key elements of the negotiations.

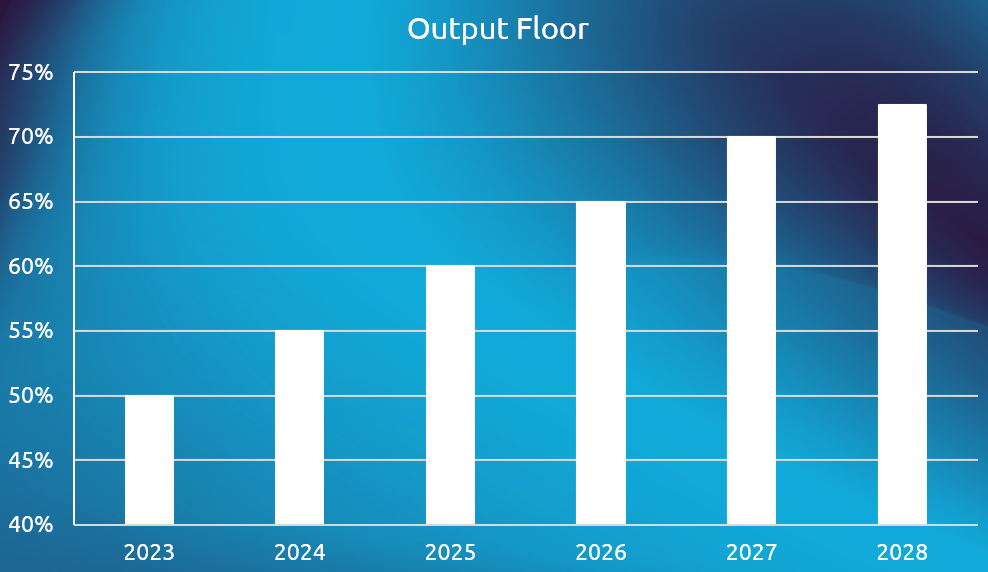

The changes will occur over a transitional period from 2022 2027 basel iii basel iv.

Deciphering the quantitative impact of basel 4.

This can also be extended to cover the combined impact across risk types credit market and operational.

Basel 4 nears completion.

Finalization of basel iii.

Basel iv introduces reductions in scope of internal models limits to parameter estimation practices new and or increased input floors as well as the capital output floor.

3 1 interaction of the output floor with other prudential requirements 21 3 2 calculation of rwas at granular level 27 3 3 scope of application of the output floor 29 3 4 role of provisions in the calculation of the output floor 33 3 5 transitional measures regarding the output floor 37 annexes 42 annex 1.

Based approaches to the calculation of risk weighted assets for credit risk.

4 as indicated the standards for the output floor which would replace the transitional capital floor adopted in basel i are still being discussed.